|

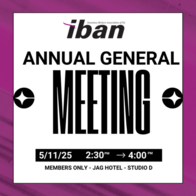

Join us for the IBAN 2025 Annual General Meeting on November 5 at the JAG Hotel, St. John's, NL.

This is a members-only event — don’t miss your chance to be part of the conversation and network with fellow professionals.

Register today by clicking HERE.

PUBLIC BULLETIN:

We want to advise that resource links have been added to the consumer section of our website HERE.

We encourage all residents—especially those in wildfire-prone areas—to review this information and take necessary precautions.

Stay informed. Stay prepared. Stay safe.

The Insurance Brokers Association of Newfoundland and Labrador (IBAN) is proud to support this year's Canada Games taking place in St. John's from August 8th - 25th. We welcome all of the country's top young athletes who will come together to compete, connect, and ignite the spirit of sport. These games however are also about bringing community together so to follow the action and stay up to date check out https://www.2025canadagames.ca/.

Archives |

RSS |